Whether you are looking to buy a house in Connecticut or put your current home on the market, it is important that you consider the state of the Connecticut Housing Market in 2024.

It is undeniable that the COVID-19 pandemic created an unprecedented impact on the Connecticut housing market, leaving buyers and sellers unsure on what to do. To add to the mix, 2022 saw a 40-year high inflation and soaring interest rates, which notably impacted the housing market. Fortunately, 2023 saw the Connecticut housing market take a turn, which continues to change as we move into 2024.

Understanding the state of the Connecticut housing market will ensure you get the most out of your sale or purchase. When you decide to sell your home, you want to ensure that there is a demand for your property and you can sell it for a good price. If you don’t sell at the right time, you may find that it becomes a stressful and time-consuming process, and you may even lose money.

When you are looking to buy a new house, you want to ensure there are plenty of options for you to choose from, at a reasonable price.

Understanding the housing market in Connecticut 2024 is the best way to make an informed decision, and buy or sell your home with ease.

Here is some important information that will help you on your journey.

What to consider when looking at the state of the Connecticut housing market in 2024?

There are two main factors that you should keep an eye on when doing a Connecticut housing market forecast for 2024:

- Housing Inventory

- Mortgage interest rates

These two factors are expected to shape the Connecticut housing market in 2024. So, let’s talk more about them!

Housing Inventory

As mentioned earlier, the inventory shortage in 2021 was one of the main reasons that drove home prices up.

Since construction wasn’t happening, the homes that are available for sale on the market could barely keep up with the demand.

For this reason, the inventory continues to be an important part of any Connecticut housing market forecast.

Additionally, most foreclosures were put on pause in previous years due to regulations related to COVID-19, which further added to the inventory problems.

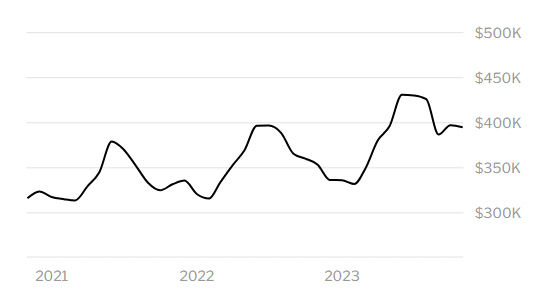

2024 is off to a good start in the housing market in Connecticut. By the end of 2023, the prices of houses were up by 11.7% compared to the year before, which shows year on year growth. Houses were being put on the market for a median price of $394,900. 59.6% of homes that sold were sold above the listed price, which is a 13.1% growth year on year.

Source: RedFin

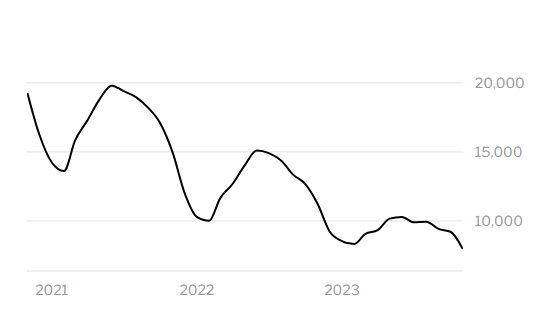

Houses spent a median number of days on the market of 36. This is down 8 when comparing year on year. The number of houses sold in Connecticut was also down, with only 3019 homes sold compared to the year before which had 3462 homes sold. There were 7962 houses for sale, which is a drop of 29% year on year. This is inline with the rest of the United States housing market, with the prices of houses up nationwide, and the number of homes for sale and homes that were sold falling.

Source: RedFin

Competitive Locations in Connecticut

- Putnam, CT

- Danielson, CT

- Moosup, CT

- Hazardville, CT

- Plantsville, CT

Areas With the Fastest Growing Sale Prices

- Putnam, CT

- Danielson, CT

- Moosup, CT

- Hazardville, CT

- Plantsville, CT

Mortgage Interest Rates

Another factor that has shaped the market in previous the past two years is that mortgage interest rates had decreased, resulting in more people qualifying for a mortgage to buy a new home, driving the sales up. This was part of the COVID-19 mortgage relief program for real estate investors. However, mortgage interest rates rose significantly in 2022, completely disrupting the market and disqualifying a large number of people and removing them from the market as potential buyers.

Mortgage rates in Connecticut as of the beginning of 2023 continued to increase, but more steadily than the year prior. As of January 2024, the average mortgage interest rate sits at 6.93% for a 30-year fixed, and 6.30% for a 15-year fixed rate. The interest rates to refinance a property are currently higher than the interest rates to purchase a property. It is likely that interest rates will begin to stablize by the summer of 2024. They will still be at a higher rate, but less than the highest level that they reached in October 2023. Interest rates have been changing recently due to the economy slowing and the labor marketing softening.

House prices

With all this in mind, the demand for properties has led to the average house price in Connecticut by the end of 2023 was sitting at $394,900. House prices in Connecticut in 2024 are likely to continue to increase due to the inventory. However, this number will vary depending on which area you are looking to buy or sell in and whether it is a larger metro area, or a small-knit community.

The following areas in particular, are predicted to see a small rise in house prices in mid 2024:

- Bridgeport, CT

- New Haven, CT

House prices have also been predicted to fall in the following areas in mid 2024:

- Hartford, CT

- Putnam, CT

With Connecticut’s current inventory of houses and interest rates stabilizing, obtaining a property may be in closer reach for many people who were denied this over the past couple of years. The housing market in Connecticut in 2024 is predicted to be much more active, stable and balanced.

The current state of the Connecticut housing market shows high prices and strong housing demand, but a decrease in sales. If you are looking to sell your home in Connecticut in 2024, at the moment you can lock in a good price for your home, with a chance of it being sold above listing price too. Connecticut is currently a sellers market, with a decreasing number of houses on the market and houses being sold. If you are interested in buying a home in Connecticut, then now is a good time to reduce seller concessions and avoid getting into bidding wars with other buyers.

Predictions for the Connecticut Housing Market in 2024

The value of a property has significantly risen in the last 5 years, and at the same time, home sales have decreased recently, which could be due to the rise in interest rates and living costs. This shows that the current housing market in Connecticut is slow. But that doesn’t mean there is no movement or opportunities to consider, especially as the number of mortgage applications has started to increase.

In 2024, it is predicted that the Connecticut housing market will see:

- Sales prices will continue to rise

- More houses will be listed on the market

- The number of buyers will increase, with an increase of baby boomers looking to downsize

- Mortgage interest rates will stay high, but begin to stabilize

- The sale of new homes will increase

Many sellers sidelined the sale of their home in 2023 to see how things played out in the market, while many buyers were unable to afford homes with the rise in mortgage rates. This means that 2024 could be looking up.

When you choose to buy or sell your home in Connecticut in 2024, it is vital that you do it at the right time. If you need additional support, contact our specialist team of real estate agents today for more help.