The capitalization rate, or cap rate for short, is an indicator on how quickly you will get a return on your real estate investment. Real estate is one of the best and most common ways that people all over the world are choosing to invest their money and secure their financial future.

The cap rate in real estate is a helpful tool. It is a measurement that is calculated by a number of factors and is a useful figure to know, so you can use it amongst other indicators to compare the value of similar investments in the market. It is a popular method used in the real estate world, as it provides you with intrinsic values.

2 Important Things to Know When Using Cap Rate Calculations

It is important to remember two things. First, the cap rate for a “safe” investment, such as a certificate of deposit (CD), is usually in the low 1-2% range. Second, this cap rate you are about to calculate doesn’t take into account factors such as increases in property value, boosts in monthly NOI, or the many tax breaks afforded to owners of multifamily properties.

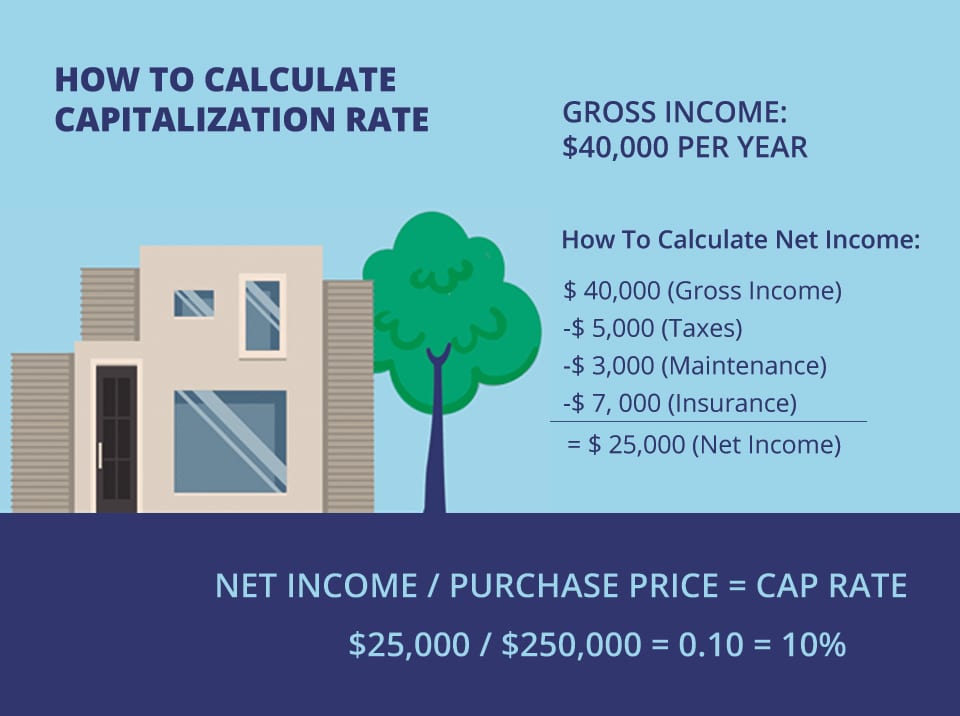

How to Calculate the Cap Rate

To calculate the cap rate, all you do is take your monthly net operating income (NOI) and multiply it by 12 (to get the annual number) and divide that number by the property’s current market value.

Is it Better to Have a Higher or Lower Cap Rate?

The key thing to understand about cap rate is that higher is not always better. A higher cap rate generally denotes higher risk and higher return. While a lower cap rate, conversely, indicates a lower risk and lower return. It is important to consider your personal circumstances and future goals when making decisions about your investments and the level of risk that you are willing to take. Use the cap rate formula as a tool to help you look at real estate investments as a whole, and take some time to ensure what is an acceptable investment and risk for your personal circumstances and comfort levels.

What is a Good Cap Rate in Real Estate?

A good rule-of-thumb is to shoot for a cap rate in the 5%-10% range. Anything lower and the investment may not have enough yield, anything higher and you want to be sure you understand all the risks associated with the investment.

What Impacts the Cap Rate?

It is important to understand the context of the property, including:

- The type of property

- The different finances it has acquired

- The stability of the property

- The location of the property

- The current state of the market

- The time of calculation

- The properties potential for growth

- The amount of capital you invested in the property

Cap rates in real estate can be a helpful tool to inform some of your decisions. There are also a range of other metrics to help you determine the returns of real estate and the level of risk.

If you have any questions on Multi-Family Investing, please feel free to give me a call.

For more tips and information on the home inspection process, or to find your next dream home, let us know!